As we navigate through August, the economic landscape is as dynamic as the summer weather. For us in the mortgage industry, staying informed about the shifts in mortgage-backed securities, inflation trends, and global interest rates is crucial. This month, significant developments could impact your strategies and client interactions.

Market Dynamics: A Closer Look

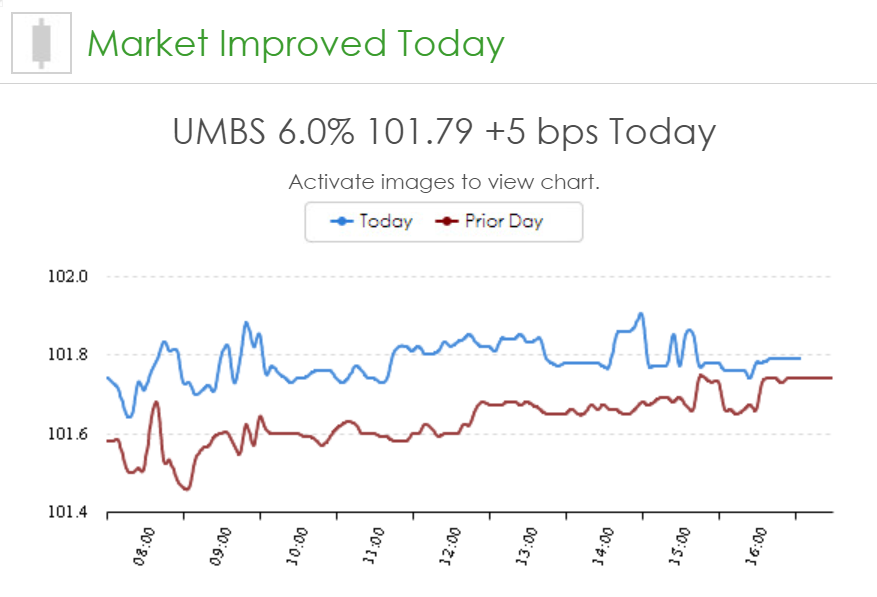

The FNMA MBS 6.00 September Coupon has shown a subtle but significant increase of 2 basis points in late trading sessions. These seemingly minor changes are pivotal for our pricing strategies and consultations. Additionally, July’s CPI figures revealed a moderate inflation environment, increasing by 0.2% month-over-month and reaching a year-over-year high of 2.9%, perfectly aligning with market forecasts.

Global Influences and Local Effects

The global stage presented its own twists with the Reserve Bank of New Zealand cutting rates by 25 basis points to 5.25%. Such international policy shifts can create ripples that reach our local shores, impacting investment flows and economic sentiments. Understanding these global connections is key to navigating the complex scenarios our clients face in refinancing and purchasing.

A Surge in Mortgage Applications

This month, we’ve witnessed a notable surge in mortgage applications, especially refinances, which jumped by 34.5%. Purchase applications have also seen a healthy increase of 2.8%. These trends provide a prime opportunity for us to guide our clients through significant financial decisions, ensuring they capitalize on the current rates.

Upcoming Economic Indicators to Watch

Keep an eye on upcoming data releases, such as retail sales and the NAHB housing index. These metrics are not just crucial for our strategies; they also serve as excellent discussion points to engage clients and demonstrate our market expertise.

Insights from Sigma Research

Sigma Research highlights a stabilization in consumer price inflation, with a comforting downward trend in mortgage rates. While this is generally positive, the data suggest a potential for market adjustments, especially with ongoing speculation about future rate cuts by the Federal Reserve. Staying ahead of these discussions can position you as a trusted expert in a fluctuating market.

Looking Ahead: The Jackson Hole Symposium

The economic spotlight is soon turning to the Jackson Hole symposium, anticipated to heavily influence market forecasts and interest rate decisions. As loan officers, preparing for these outcomes and devising proactive strategies will ensure that we continue to provide top-notch guidance.

Navigating Forward

In the fast-paced world of mortgage lending, being well-informed is more than a necessity—it’s a strategic advantage. By understanding and anticipating market movements, you can offer invaluable advice that not only wins client trust but also cements your reputation as an industry leader.

Stay current with the latest updates and expert analysis with RateAlert.com